- #You need a budget vs mint how to#

- #You need a budget vs mint full#

- #You need a budget vs mint android#

- #You need a budget vs mint software#

- #You need a budget vs mint free#

As a Mint account holder, you’ll have real-time access to your credit score.

#You need a budget vs mint full#

Mint will then automatically populate this data into your account so you can have a full understanding of your financial picture-all in one place.

#You need a budget vs mint android#

Android users can download the app in the Google Play Store, where Mint is rated at 4.6 stars (out of 5).Īs an account holder, Mint will help you link all of your external financial accounts to your centralized Mint dashboard. You can also download the Mint app, which is rated at 4.7 stars (out of 5) in the App Store. Mint’s spending and budgeting tools are available through an online account.

#You need a budget vs mint free#

Get started today, risk-free, with their 34 day free trial. YouNeedABudget YNAB helps you save money and get a handle on your finances.

#You need a budget vs mint how to#

YNAB is most commonly accessed via its powerful apps, which are highly rated, with a near-perfect 4.8 stars (out of 5) in the App Store. If you’d like to learn more, here’s a quick video that gives an overview of the four rules. The strategy behind YNAB’s saving and spending principles can be summarized by their Four Simple Rules for Successful Budgeting, which are as follows:Įach interaction you make with your YNAB account will, in one way or another, tie back to the rules listed above. When it comes to educating you about being fiscally responsible, YNAB takes things one step further.

#You need a budget vs mint software#

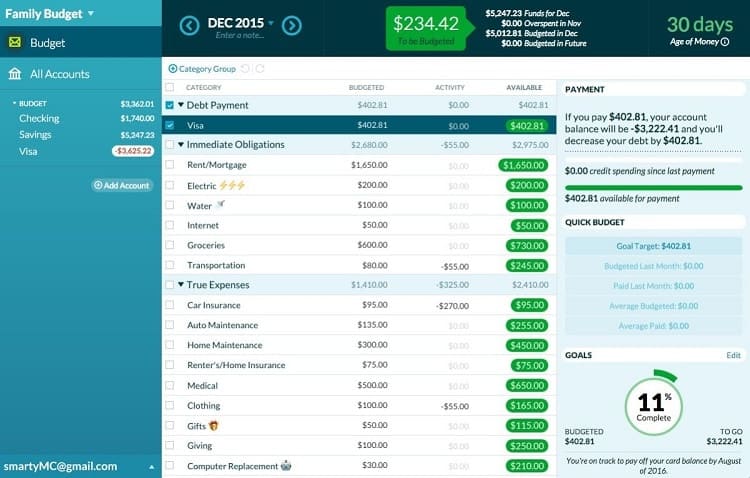

YNAB offers personalized budgeting software that can be accessed through an online account or via mobile apps. The company now has over 20 million users and is widely recognized as the most popular budgeting app. In 2009, Intuit acquired Mint for $170 million. Mint was initially founded in 2007 and quickly grew its user base to over 2 million subscribers. Mint is a financial tracking app and budgeting tool. To be clear, YNAB is all about helping you save money and budget better. They also offer educational resources that help you get a better handle on how you’re spending money so you can identify areas where you can save. YNAB is a small, privately held company that offers personal budgeting software. YNAB stands for “You Need a Budget.” The company was founded in 2004 by a husband-and-wife team Julie and Jesse. Let’s jump right in and start with the basics. Keep reading to learn more about where each product shines and also where they fall short.

To make your decision-making process easier, I’ve put together a post that provides an overview of both Mint and YNAB, the pros and cons of using each service, and other interesting details you might be interested in. After all, it would be counterproductive to sign up for both services the entire purpose of an online budgeting tool is to reduce the number of accounts you have to log in to. If you’re looking to use a budgeting app to get a better handle on your finances, you might be wondering whether Mint or YNAB meets your needs more effectively. Both companies also offer easy-to-use apps that keep you informed of your finances wherever life takes you. You can use both services to track your spending, savings, and debt amounts, among other things. Mint and YNAB are two of the world’s most popular online budgeting apps. This article includes links which we may receive compensation for if you click, at no cost to you.

0 kommentar(er)

0 kommentar(er)